Asset Management.

Asset Management, Defined.

Asset management is a broad term but generally, it means having your assets or portfolio managed by a third party, typically an investment manager or advisory firm. The asset manager’s role is to guide investment decision-making to build a portfolio that reflects your financial goals, time horizon and risk tolerance.

These services can be offered by individual asset managers or through a larger investment bank. Often, asset management firms cater to higher net worth and wealthier investors who have significant investable assets to work with. There may be investment minimums that you’re required to meet to work with a particular asset management firm, for example.

While individual asset managers or firms may take different approaches in the range of products or services offered, the underlying goal is the same: to grow their clients’ portfolios while minimizing risk. They do that by developing an investment strategy that factors in their clients’ risk tolerance, investing timeline and unique preferences.

What Does An Asset Manager Do?

An asset manager’s primary function revolves around making investment decisions on behalf of their clients. That includes determining whether and when to sell or buy specific securities.

Asset management firms spend time researching and analyzing various investment opportunities. How this is done typically depends on the firm’s overall investment strategy. For instance, an asset manager may rely more heavily on fundamental analysis than technical analysis or vice versa. They may study stock market trends on a narrow or broad scale to decide where to invest.

In terms of where asset managers may choose to invest their clients’ portfolios, the list includes the standard investment options, such as stocks, mutual funds and bonds. But depending on the client, an investment manager may also look toward alternative investments, such as real estate, hedge funds, commodities, currencies, private equity and master limited partnerships.

In a typical asset management relationship, investors deposit cash into a money market account or brokerage account which their investment manager has access to. The investment manager can then buy or sell investments as needed, according to the investment strategy they’re pursuing on behalf of their client. The management itself can be either discretionary or non-discretionary. In the former, portfolio managers make investment decisions at their own discretion; in the latter, investment decisions must be discussed and approved by clients before portfolio managers make trades.

Asset managers can be fiduciaries but they’re not required to follow a fiduciary standard. Observing fiduciary duty means that an investment professional is legally and ethically bound to act in the best interests of their clients at all times. If you’re not sure whether an asset management firm or individual is a fiduciary.

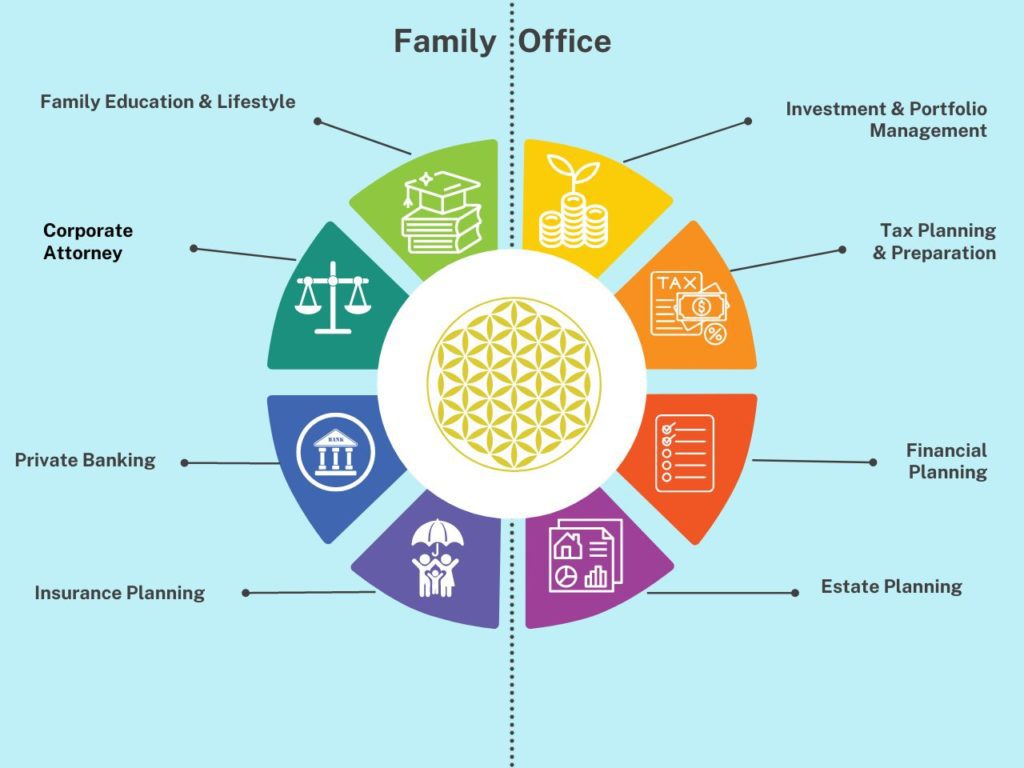

Family Office Chart

Creating Relationships Measured in Decades

Please utilize the following sections to accentuate the characteristics of the heading. These paragraphs aim to concentrate on the subject matter of your choice. It is highly recommended to maintain a succinct and compelling presentation.

01.

Financial Planning

Wealth can be a tricky and multi-layered issue, often leading to complex problems that require careful and strategic solutions.

02.

Portfolio Construction

All of our portfolios are developed as a function of our clients' specific goals and risk tolerances.

03.

Tax & Estate Planning

Investing for legacy means considering the legacy one wishes to leave behind and making investments that align with their personal values and goals.

04.

Partner Coordination

In short, collaborating with your CPA and attorney is an investment in the long-term success of your business.

About us.

As an esteemed and trusted financial services provider, Von Keller & Co. Family Office takes immense pride in being 100% family-owned. Over the years, we have gained an extensive understanding of the industry and have found that, all too often, other industry players fail to serve their clients truly. Our priority is always our clients’ wellbeing, and we consistently provide them with consultative and advisory services that are genuinely customized to their particular needs and goals.

“While Von Keller & Co. manages the assets of the Trust, which funds the Von Keller Foundation, neither Von Keller & Co. nor the Trust plays a role in the grantmaking or operations of the foundation. Additionally, the foundation does not control or participate in the Trust’s investment activities. To learn about the foundation’s work, visit its website at von-keller.org. For more information about the foundation’s animal conservation efforts, please visit the same website.”