Wealth Management.

Asset Management vs. Wealth Management.

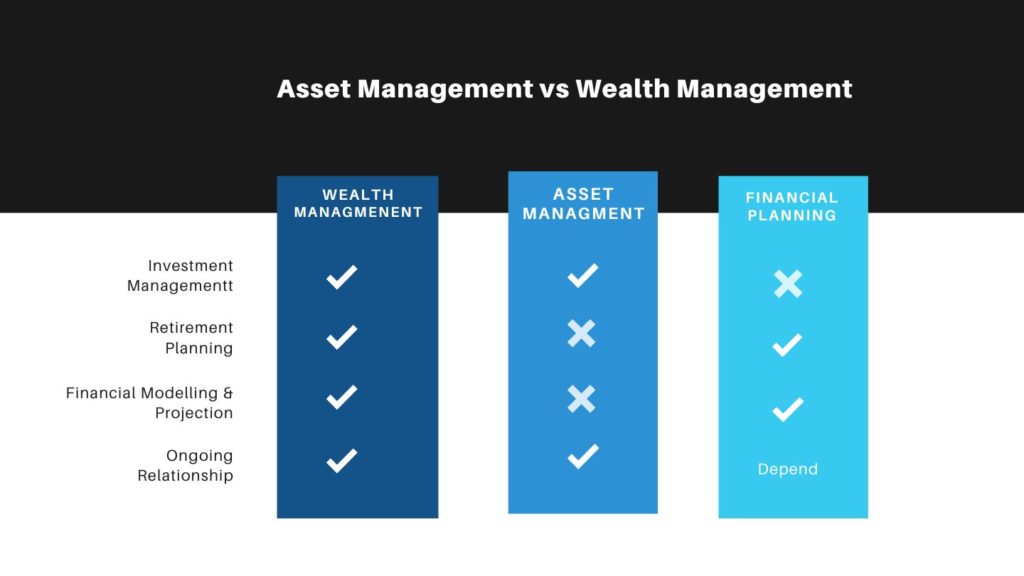

When searching for a financial professional, you may wonder whether you need asset management vs wealth management. How are they different? Advisory firms offer a range of services and may specialize in one area too. With so many synonyms for financial advisors, it’s hard to find what differences exist. While there is not a formal definition, here’s how we view asset management vs wealth management and the differences between the two services.

Wealth Management vs Asset Management: What’s the Difference?

Asset management focuses on managing the money in your investment accounts, such as an IRA or brokerage account. Investment management is everything from setting your asset allocation, managing ongoing investment risk by diversifying, rebalancing, tax-loss harvesting, to working to ensure your accounts are structured so your overall investment portfolio is aligned with your goals and income needs.

Wealth management includes asset management but expands to encompass financial planning, retirement planning, tax planning, and ongoing advice. Since investing and financial planning are intertwined, it’s often best to look at everything together. This includes retirement planning, tax considerations, and robust financial modeling and stress-test simulations.

Creating Relationships Measured in Decades.

You can use these sections to highlight the features of heading. Use these paragraphs to focus on the topic you want. Make sure you keep it short and attractive.

01.

Financial Planning

Wealth can be a tricky and multi-layered issue, often leading to complex problems that require careful and strategic solutions.

02.

Portfolio Construction

All of our portfolios are developed as a function of our clients' specific goals and risk tolerances.

03.

Tax & Estate Planning

Investing for legacy means considering the legacy one wishes to leave behind and making investments that align with their personal values and goals.

04.

Partner Coordination

In short, collaborating with your CPA and attorney is an investment in the long-term success of your business.

About us.

As an esteemed and trusted financial services provider, von Keller & Co. Family Office takes immense pride in being 100% family-owned. Over the years, we have gained an extensive understanding of the industry and have found that, all too often, other industry players fail to serve their clients truly. Our priority is always our clients’ wellbeing, and we consistently provide them with consultative and advisory services that are genuinely customized to their particular needs and goals.

“While von Keller & Co. manages the assets of the Trust, which funds the Von Keller Foundation, neither von Keller & Co. nor the Trust plays a role in the grantmaking or operations of the foundation. Additionally, the foundation does not control or participate in the Trust’s investment activities. To learn about the foundation’s work, visit its website at von-keller.org. For more information about the foundation’s animal conservation efforts, please visit the same website.”